NFTs Tokenomics: getting started for a successful NFT business

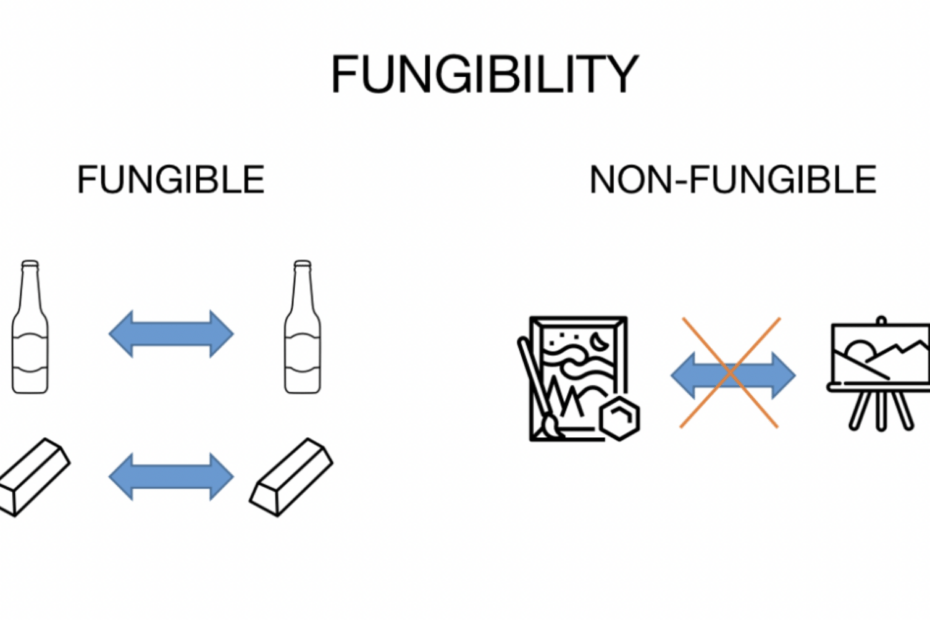

How to make a NFT business? The term NFTs stand for “non-fungible tokens”, these type of token represent ownership of digitally scarce goods such as… Read the full news »NFTs Tokenomics: getting started for a successful NFT business