3 IDO & IGO platforms and token launchpads

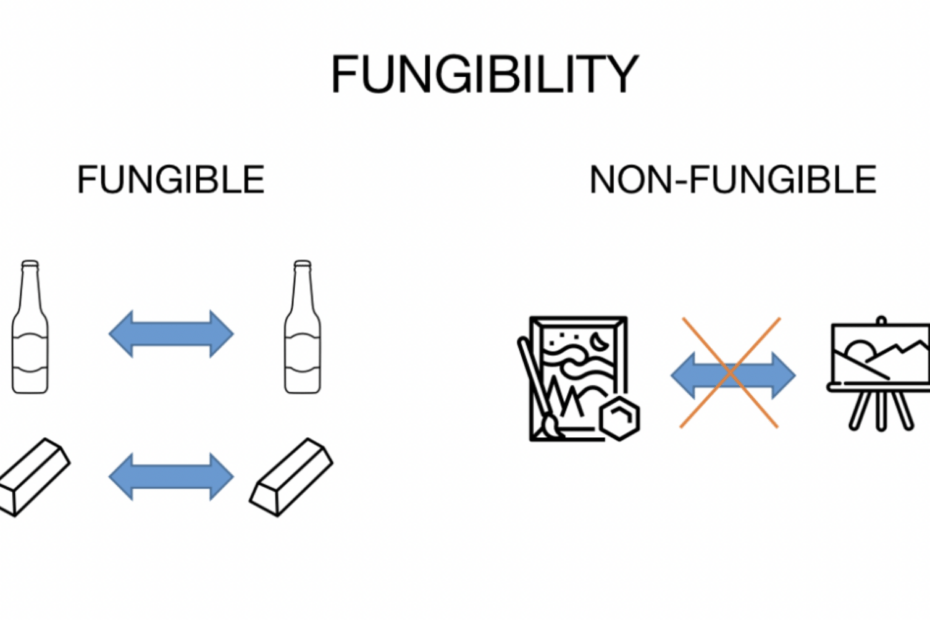

Introduction Any new crypto initative that requires to sell a token require a platform to advertise the initiative and reach as many potential investors as… Read the full news »3 IDO & IGO platforms and token launchpads